Something about the United Nations Framework Convention on Climate Change (UNFCCC) at the 21st Conference of the Parties (COP 21) in Paris, in December 2016

To begin with, there is no consensus on what causes global warming, although most scientists understand the anthropogenic importance of this issue. Taking that into account, I will make a brief comment.

The point

Scientists at the United Nations Intergovernmental Panel on Climate Change (IPCC), who advocate the idea of global warming with strong anthropogenic influence, have made it clear that some impact of climate change is inevitable, but there is still time to protect humanity from some of the most disastrous consequences. This reaction should come as part of a rapid shift in global strategies to avoid significant carbon dioxide (CO2) emissions.

The counterpoint

Critics, on the other hand, argue that models have mathematical failures and that external factors not taken into account could be altering the positions upward. Critics contend that climate simulations are unable to model particle cooler effects, to adjust water vapor feedback and to account for the role of clouds. Critics also argue, contrary to what is accepted by most of the scientific community, that the Sun may have a greater share of responsibility for the global warming currently observed. Some indirect solar effects may be very important and may not be taken into account by models. Thus, the share of the global warming caused by human action could be smaller than what is currently thought.

The tangency point

However, both sides of the scientific community agree that global temperature has risen by one degree since late nineteenth century, that atmospheric CO2 levels have risen by about 30% over the same period and that this trend may contribute to a future increase in global warming.

The results obtained by COP 21

Overall, the COP 21 results confirm their claims. Among the 195 participating countries, the main emitters of CO2 are China, the United States of America[1], the European Union, India and Brazil (mainly due to the deforestation of the Amazon rainforest), which have committed themselves to work to keep the warming process below 2 ºC, seeking to limit it to 1,5 ºC until the end of the 21st century. For this purpose, rich countries must secure an initial funding of US$100 billion per year from 2020 to 2025, and, in this case, the exit of the United States would be a problem. The COP 21 does not mention the percentage of greenhouse gas emissions cut needed to reach the targets or when emissions need to stop rising. On the other hand, from 2018 on, the agreement should be reviewed every five years, when the COP 21 work should be adjusted and the emission cuts, suggested.

The energy matrices of China, the United States, Brazil and the Organization for Economic Co-operation and Development (OECD)

From the point of view of the classical energy balance, which encompasses the trajectory that starts at the primary availability until it reaches the final demand, passing through the transformation centers, we can count on the work of the International Energy Agency (IEA), in which the balance sheets of the world, from each country and by blocks of countries, from 1971 to 2014, appear within the same methodological standard published in their graphic and traditional form. By adding the useful energy to the classical balance, we open ways to measure the efficiency of energy by activity sector and by energy source as well as by the matrix itself, under the forms of mechanical energy, process heat, direct heating, chemistry, refrigeration or lighting. For this reason, China stands out, both for its magnitude and economic strength and for the contribution of texts found in the literature, in particular the work of Paul Edward Brockway et al. (2015) Understanding China’s past and future energy demand: an exergy efficiency and decomposition analysis. In this study, the authors work with the concept of exergy[2], also tackling that of useful energy, which can be summarized in a table specifically developed by the authors, in which useful energy was considered in details under its thermal, mechanical, electrical and muscular forms. In 1971, the aggregate exergetic efficiency totaled 5.3%, relating useful energy to primary exergy; in 2010, this ratio reached 12.5%. In the Sankey diagram, the authors also place primary energy in its conventional form, according to the IEA criteria, along with the primary exergy, which will allow a comparison with the efficiencies of the selected countries, including China itself, Brazil (and Rio Grande do Sul) and the United States. In 1971, in China, the aggregate efficiency was 9.6% and, in 2010, 15.7%. In other words, in the Asian country, of everything that counts as primary availability in the energy system, only 15.7% is used. In 2014, this rate was 33.4% for Rio Grande do Sul and 45.6% for Brazil. In 2015, it was 39.4% for the United States. Regarding the indicator of efficiency for the electric sector, we have 52.0% for RS, 62.0% for Brazil and 33.7% for the United States. Increasing losses are related to the use of much lower efficiency coal. It is noted that China has a low efficiency matrix[3]. Considering the size of the country’s economy and its high development rates, we can imagine the impact on the environment and on natural resources. On the exergetic side, in 2010, its losses reached 87.7% of the primary availability.

Opening up the discussion a little more — considering especially national energy matrices due to the large hydric share in the generation of electricity —, alongside the electric sector itself, yields are 53.6% for Rio Grande do Sul, 62.0% for Brazil and 33.2% for the United States, which use mainly coal.

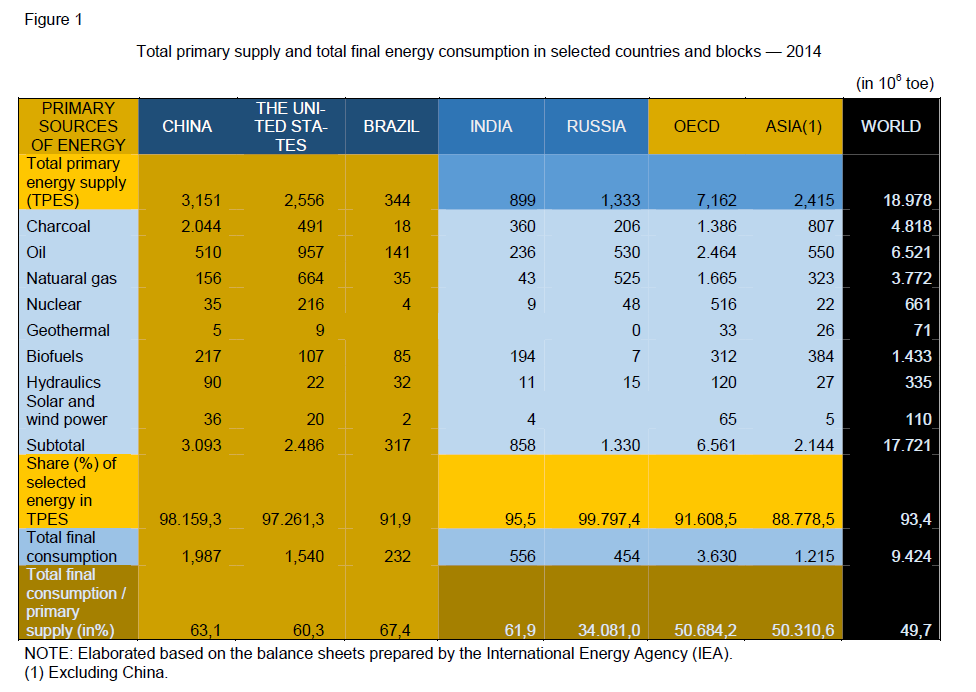

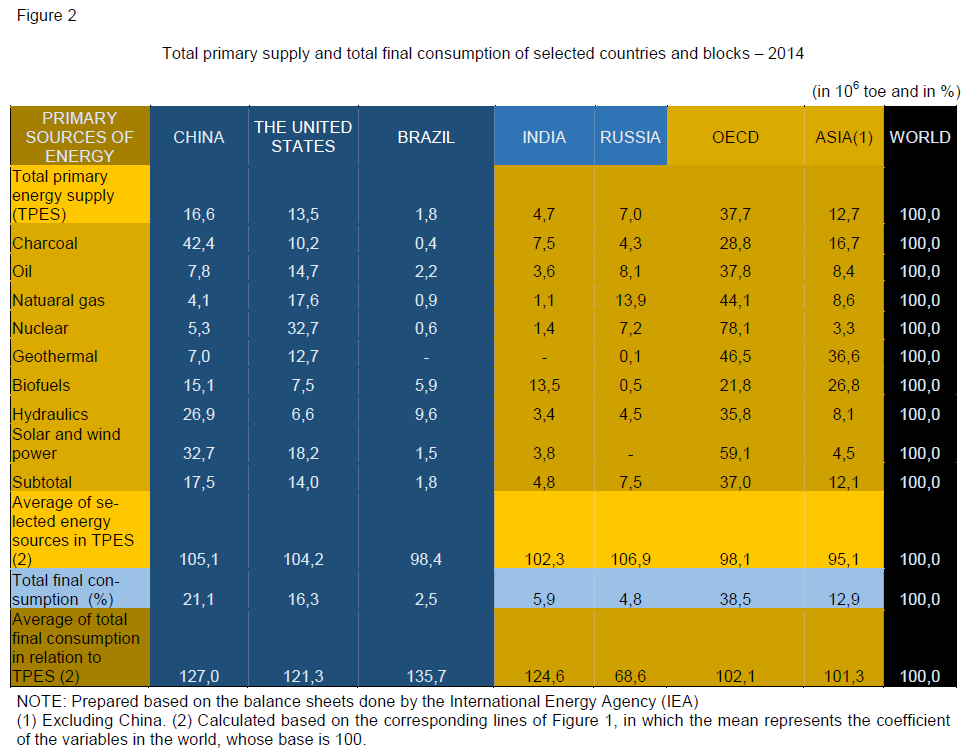

Figures 1 and 2, which refer to 2014, highlight China, the United States and Brazil in terms of total final consumption and total primary energy supply (TPES), including their main energy vectors. For comparison purposes, countries such as Russia and India are introduced, as well as the OECD and Asia, except for China.

By way of illustration, the United States and China together account for 30.1% of the world TPES (16.6% for China and 13.5% for the United States), the OECD accounts for 37.7%, and Brazil, for 1.8%.

When considering the global TPES of the energetic vector highlighted, in this case, coal, China represents 42.4% of the total. On the other hand, renewable energy sources — wind and solar — from China account for 32.7%, from the United States, for 18.2%, from the OECD, for 59.1% and from Brazil, for 1.5%.

Considering the structure of these countries for the total primary supply of energy, for 2014, divided into fossils — oil, coal and natural gas — and renewable energy — biodiesel, solar, wind and hydraulic, we have (a) for fossils: 86.0% (China), 82.6% (United States), 56.4% (Brazil) and 77.0% (OECD); (b) for renewable energy: 10.9% (China), 5.8% (United States), 34.6% (Brazil) and 6.9% (OECD), which gives a clear advantage to Brazil’s energy matrix in relation to the emissions of CO2. This “photograph” of 2014 shows a clear world of fossils, notwithstanding the technological efforts in favor of renewable energy.

The CO2 emissions from the energy matrices of China, the United States, Brazil and Rio Grande do Sul

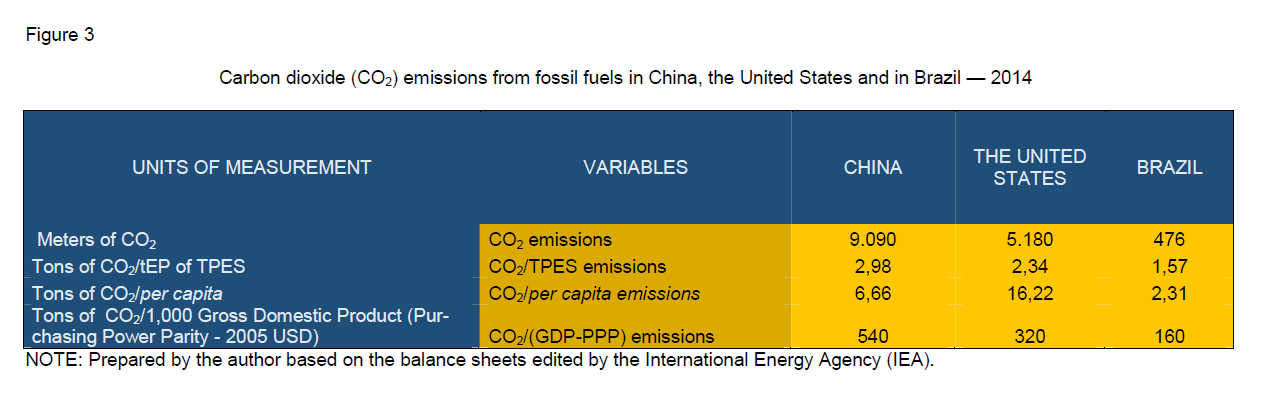

Figure 3 shows the CO2 emissions through some variables used to indicate the comparison between countries or blocks of countries, in this case, China, the United States and Brazil, revealing, for the year 2014, the significant amount of CO2 emitted by both China and the United States: 9.1 and 5.2 billion tons respectively. Meanwhile, Brazil emits 0.5 ton, a result derived from the structure of its energetic matrices in fossils and renewables, as seen in the previous item, and the magnitude of its economies. Another indicator that I consider important is the ratio of CO2 emissions per unit of purchasing power of the Gross Domestic Product (GDP) in US dollars in 2005. In other words, a unit of GDP generates 0.54 kg of CO2 for China, 0.32 kg for the United States and 0.16 kg for Brazil.

The world energy matrix is based on fossil energy (which is also true for the selected countries), despite the recent and rapid growth of wind, solar and biofuels energy. The specialized literature, in its projections for 2050, says that fossils will continue to grow at rates lower than that of the renewables, albeit with relative loss in the structure of the energy matrix. Fossils will continue to produce increasing environmental impact unless agreements, such as the COP 21, and technological progress, at a competitive cost, come to curb this trend.

Mutation point

Regardless of the position of scientists who diverge in their diagnosis, if the idea of combating global warming continues, it will catalyze a major battle between two “kingdoms”, the one of fossils (oil, gas, coal, etc.) and the one of renewable energy (water, bioenergy, wind, sun, etc.). In this battle, if the “new king” wins, it will inaugurate a new era, whose basis will result from two vectors: that of technology and that of its competitive costs. On the other hand, the resulting energy matrix would propagate in a decentralized way and would have an important role, already during the transition. It is a revolution of the ways of production, which would be totally redesigned, and human society could make an unprecedented qualitative leap. Concentrations of power would give way to the atomization of supply, but the powerful ones of the “old kingdom,” along with the war industry, will do their utmost to present themselves as a duet.

[1] The United States is withdrawing from Cop 21, which may jeopardize the results of the Convention, considering the transfer of rich countries to guarantee the initial financing from their new presidency, which can be mitigated by the federal states due to the strength of their constitutions, which are more comprehensive than the constitution of the Union, which has residual amplitude and legislates on what states do not legislate.

[2] Exergy is the maximum work that can be obtained through the most appropriate process of a system that is in an initial state until it reaches the final state, characterized by the thermodynamic equilibrium with the environment. This concept can be also defined as the maximum work potential of a substance or the minimal work done to bring the system out of its dead state. Potential and kinetic exergies are equal to potential and kinetic energies, but they are mathematically different in physical and chemical terms.

[3] This low value of efficiency of China presented here, besides the coal vector and its matrix structure, may be due to the introduction of the concept of exergy, but I tried to get around the problem by using data from the International Energy Agency.